Trademark law is deceptively simple, but there are traps for the unwary. One of those traps is the doctrine of “related products“. Here’s how this works.

Let’s say you have chosen what you believe to be a distinctive trademark for fruit juice. Let’s call it AWESOME BEV. So, you properly performed a trademark clearance search. You find that no one else has registered or applied for AWESOME BEV for non-carbonated, non-alcoholic beverages. You file your trademark application and it gets rejected on grounds that it is confusingly similar to the same trademark owned by Gallo Wines for wine. What, you say, I’m not selling wine so what’s the problem? The problem is that non-alcoholic and alcoholic beverages may be considered “related” products. What constitutes a related product is not based on what you think. Rather, it’s based upon what a reasonable consumer may think. In the words of one court:

The goods or services of the applicant and the registrant need only be related in some manner and/or the circumstances surrounding their marketing are such that they could give rise to the mistaken belief that they emanate from the same source. ” Coach Servs., Inc. v. Triumph Learning ….

In our example, assuming the average consumer is familiar with Gallo’s widespread marketing activities and its dominance in the beverage market, your marketing of non-carbonated, non-alcoholic drinks under the AWESOME BEV trademark could give rise to the mistaken belief by consumers purchasing juice that AWESOME BEV belongs not to you but to Gallo even though Gallo only uses the mark on alcoholic drinks.

This is a relatively simple example, but it can get complicated. Let’s take a real life example involving the trademark LEHMAN BROTHERS. Most of us are familiar with this trademark, which belonged to the now defunct financial services firm of the same name. Lehman Brothers was one of the largest investment banks in the United States until it filed for bankruptcy in 2008. As part of the bankruptcy proceedings, Lehman Brothers assigned all of its trademarks to Barclays Capital Inc. (Barclays). Barclays failed to renew the trademark registrations and let them expire. Another company, Tiger Lily Ventures, Ltd. (Tiger Lily), stepped in and in 2013 registered LEHMAN BROTHERS for “beer and spirits” and, later, filed again, for “bar services and restaurant services.” In the same year, 2013, Barclays filed an application to register LEHMAN BROTHERS for financial services. It also filed cancellation actions with the Trademark Trial and Appeal Board (Board) against Tiger Lily’s registrations. Among its many arguments was that the LEHMAN BROTHERS trademark had not been abandoned even though the registrations had lapsed and that Tiger Lily’s registrations created a likelihood of confusion.

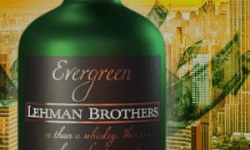

After receiving evidence from the parties, the Board held that Barclays had not abandoned the trademarks and that Tiger Lily’s registrations caused a likelihood of confusion. Barclays provided evidence that Lehman Brothers distributed promotional materials such as whiskey decanters, wine gift sets, wine books and other wine related promotional items. It also provided evidence that the LEHMAN BROTHERS mark was prevalent in pop culture such as in movies, television shows and music. The evidence was sufficient enough to persuade the Board that Tiger Lily’s use of the LEHMAN BROTHERS mark was likely to cause confusion as to the source of goods. Tiger Lily appealed to the U.S. Court of Appeals for the Federal Circuit.

At first glance, the Board’s decision doesn’t make sense. What does investment banking have to do with beer and spirits and restaurant-bar services? How could consumers be confused over the source of goods and services? Here’s what the Federal Circuit said about the Board’s decision after affirming that Barclays had not abandoned the LEHMAN BROTHERS trademark:

Barclays is correct that in modern consumer markets commercial trademarks are often licensed for use on products that may differ from the original source of the trademark. See, e.g., L.C. Licensing Inc. v. Berman, 86 U.S.P.Q.2d 1883, 1889 (T.T.A.B. 2008) (“It is common knowledge, and a fact of which we can take judicial notice, that the licensing of commercial trademarks on ‘collateral products’ has become a part of everyday life.”). In this regard, the Board relied on Barclays’ extensive evidence showing examples of companies that have promoted financial services through use of their trademarks in connection with alcohol, food, and beverages. See, e.g., Board Decision, slip op. at 43–46 n.68. And the evidence demonstrates that, in marketing its own banking products and services, Lehman Brothers used its LEHMAN BROTHERS mark in connection with products that are related to whisky and alcoholic beverages. See, e.g., J.A. 17664 (Lehman Brothers Whisky Decanter), J.A. 17696 (Lehman Brothers Beverage Cooler) Emphasis added.

The Federal Circuit also noted that famous marks such as LEHMAN BROTHERS, are accorded a broad scope of protection and though it may be true that Tiger Lily was not purposely trying to confuse customers as to the source of its goods, the evidence demonstrates that “Tiger Lily is seeking to take advantage of the widespread consumer recognition of Barclays’ LEHMAN BROTHERS mark.” Thus, the Court of Appeals affirmed the decision of the Board.

This case underscores how important it is to perform due diligence on your trademarks before filing, particularly if you are reviving a so-called abandoned mark. Don’t assume that the goods and services you intend to offer under your trademark are not related to goods and services on someone else’s confusingly similar mark. And don’t assume that the mark is abandoned.

— Adam G. Garson, Esq.